40 rich dad poor dad assets liabilities diagram

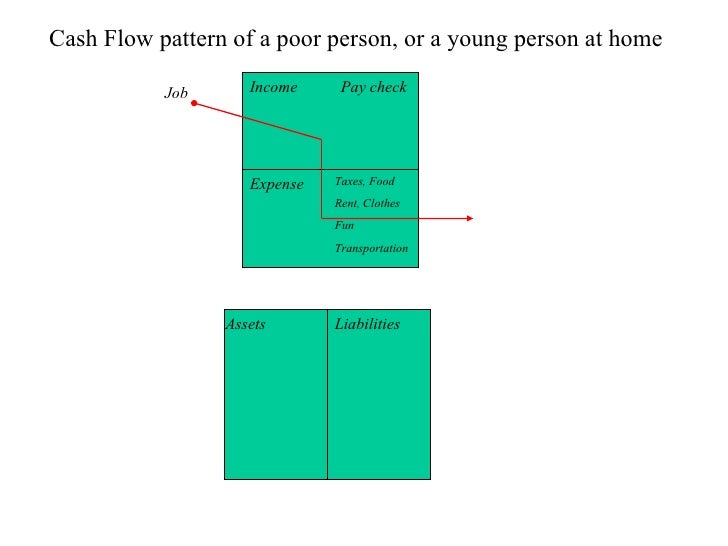

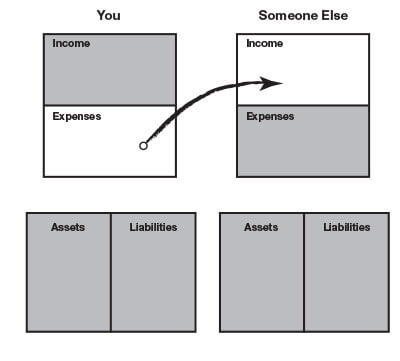

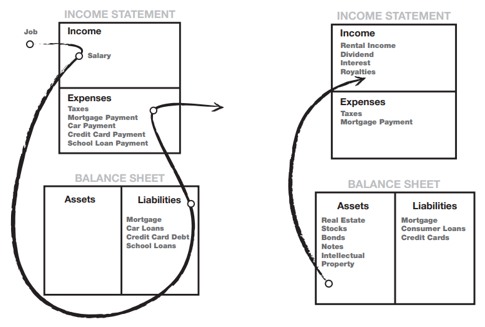

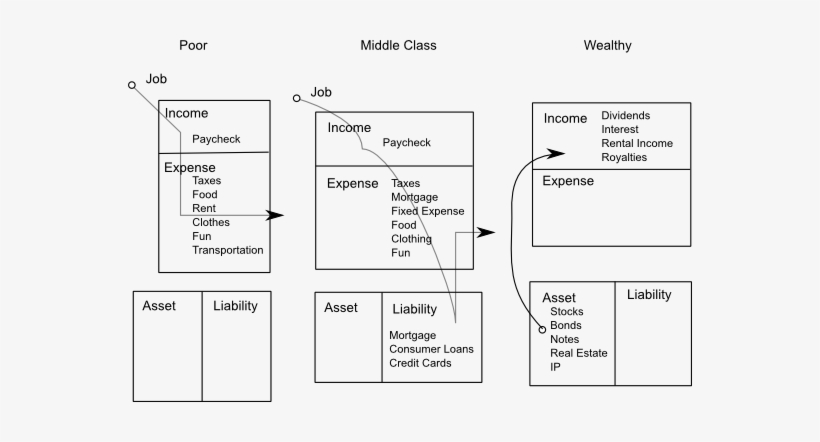

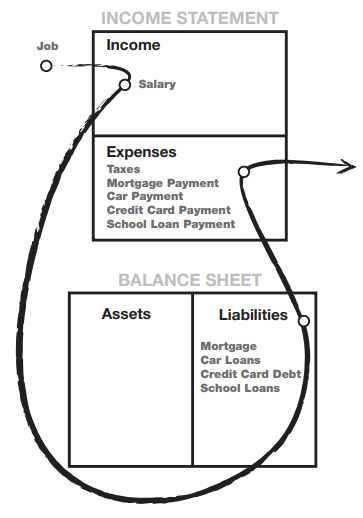

Mar 30, 2013 · Rich. Assets(stocks bonds notes real estate intellectual property)->income (dividends interest rental income royalties) Liabilities (none) The diagrams show the flow of cash through a poor, middle class or wealthy person’s life. It is the cash flow that tells the story. It is the story of how a person handles their money, what they do after they get the money in their hand. “The rich acquire assets and the poor and middle One of the things I learned from my rich dad when I was nine years old was what determined if something was an asset or a liability—and it is not what your banker or your real estate broker calls it. What determines if something is an asset or a liability is a very important word—probably the most important word in business and investing.

Rich Dad Poor Dad. Two dads. The rich don’t work for money. Assets and liabilities. Conclusions. Rich Dad Poor Dad. Rich Dad Poor Dad is a very famous work by Robert Kiyosaki. It has spawned more than a dozen sequels, many lucrative consciousness-raising tours and even a board game. We don’t normally cover the “self-help” end of finance ...

Rich dad poor dad assets liabilities diagram

Sign In. Details ... Dec 25, 2020 · Assets Versus Liabilities: A Rich Dad Poor Dad Lesson! This article is a guest post from the blog Investors On The Rise. A very important lesson I have learned throughout my self-studies of personal finance is from the book Rich Dad Poor Dad by Robert Kiyosaki. Rich don't give a damn about Liabilities, they work on acquiring assets. They know that most of the world is in the trap of working hard, making money, paying bills, sleep and repeat.

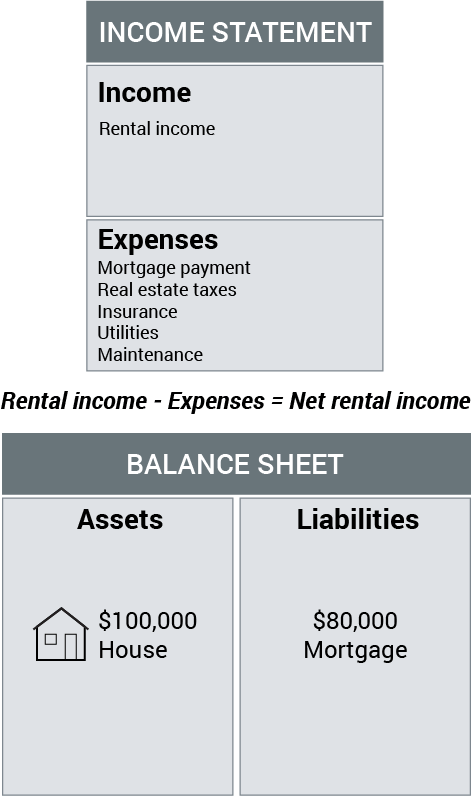

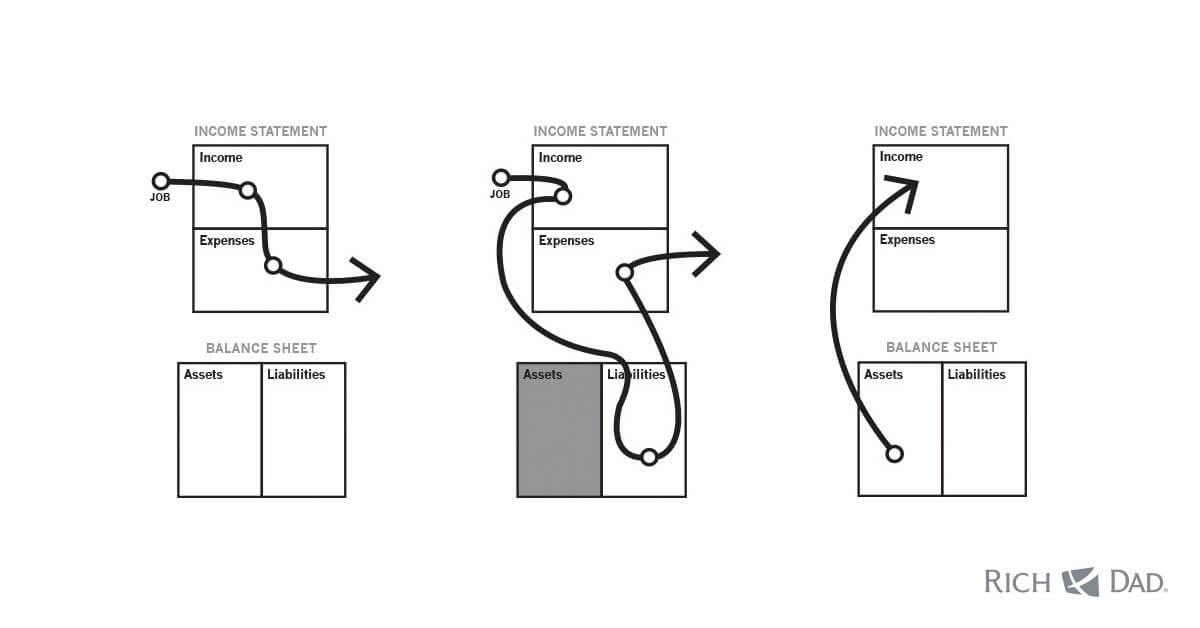

Rich dad poor dad assets liabilities diagram. Rich Dad Poor Dad Summary. "There is a difference between being poor and being broke. Broke is temporary. Poor is eternal.". "Money comes and goes, but if you have the education about how money works, you gain power over it and can begin building wealth.". "People's lives are forever controlled by two emotions: fear and greed.". Jul 26, 2020 · Rich Dad, Poor Dad ‘s cash flow chart offers a unique idea. When you work for an employer, you get paid only a fraction of the value that you generate for the employer (otherwise, if the business would go bankrupt). Say your salary is $50k a year. Your work may allow your employer to earn $100k in sales that year, yielding a clean profit ... Audible - Get 2 FREE audiobooks of your choice | http://amzn.to/2b9GBJr___Subscribe 💪 http://bit.ly/illacertusBuy "Rich Dad Poor Dad" in the USA - http://am... The answer is, of course, no. In order to know for sure, you would need to refer to the income statement to see if it was an asset or a liability. Why your house is a liability. To illustrate this, rich dad drew this diagram: An income statement showing expenses but no income from a cash-flowing property. This shows how a house is a liability ...

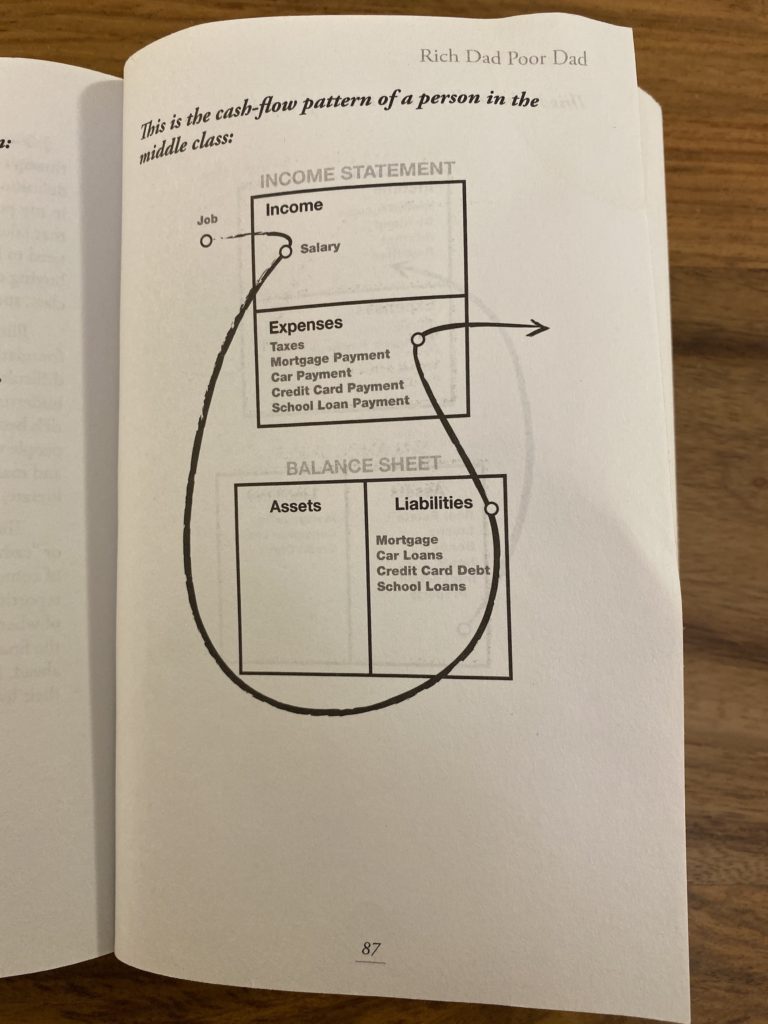

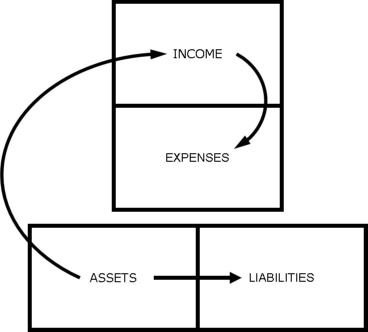

Rich Dad, Poor Dad: image: author: Robert Kiyosaki: country: ... of money and emphasizes the need for accounting knowledge so that the reader clearly understands what assets and liabilities are. He makes simple diagrams that show the inflow and outflow of money and how the rich build up the asset column and the poor build up the liability ... In this short video, let's look at one the most important lessons from Rich Dad Poor Dad by Robert Kiyosaki.Let's look at how to think about your assets and ... Rich Dad Assets/Expenses Tithing ***measured in months Credit Card #1 Credit Card #2 Car Loan #1 Car Loan #2 School Loan #1 School Loan #2 Bank Accounts Credit Cards Stocks Car Loans TOTAL LIABILITIES NET WORTH per Banker NET WORTH per Rich Dad (Total Assets per Banker minus Total Liabilities) (Total Assets per Rich Dad minus Total Liabilities) On this blog post, you will learn about the difference of assets vs liabilities and why your house is not an asset. Read these separate blog posts about Rich Dad Poor Dad summary, the concept of cashflow quadrant, and types of investors by Robert Kiyosaki.

Rich Dad Poor Dad Diagram. The author Robert Kiyosaki uses simple diagrams to explain very complex money concepts. The most important of them all is to understand the difference between assets and liabilities. This is how he explains it using this diagram. This one is arguably the most powerful diagram in personal finance. Oct 09, 2012 · Want to be rich? It’s about assets vs. liabilities. My poor dad always told me, "You need to read books." My rich dad always told me, "You need to be financially literate." I believe both were right. Books and learning are important, and so is a strong financial education. And if I had to choose one over the other, I'd choose financial education. Is your house an asset or a liability? Robert Kiyosaki of Rich Dad Poor Dad challenged the traditional definition of Asset and Liability in his famous book t... Personal Financial Calculator. Get a clear and up-to-date snapshot of your financial report card. This personal financial statement is very similar to the scorecard used in the CASHFLOW game. As you fill in the numbers monthly or quarterly on the Income Statement and Balance Sheet, the spreadsheet will analyze where you are now and will give ...

In Rich Dad, Poor Dad chapter 1, you'll learn about how cashflow works and how you can make it work for you. Rich Dad, Poor Dad Chapter 1: The Rich Don't Work For Money - Money Works for Them. With the narrative over, the rest of the book covers Robert Kiyosaki's major lessons from Rich Dad in Rich Dad, Poor Dad chapter one.

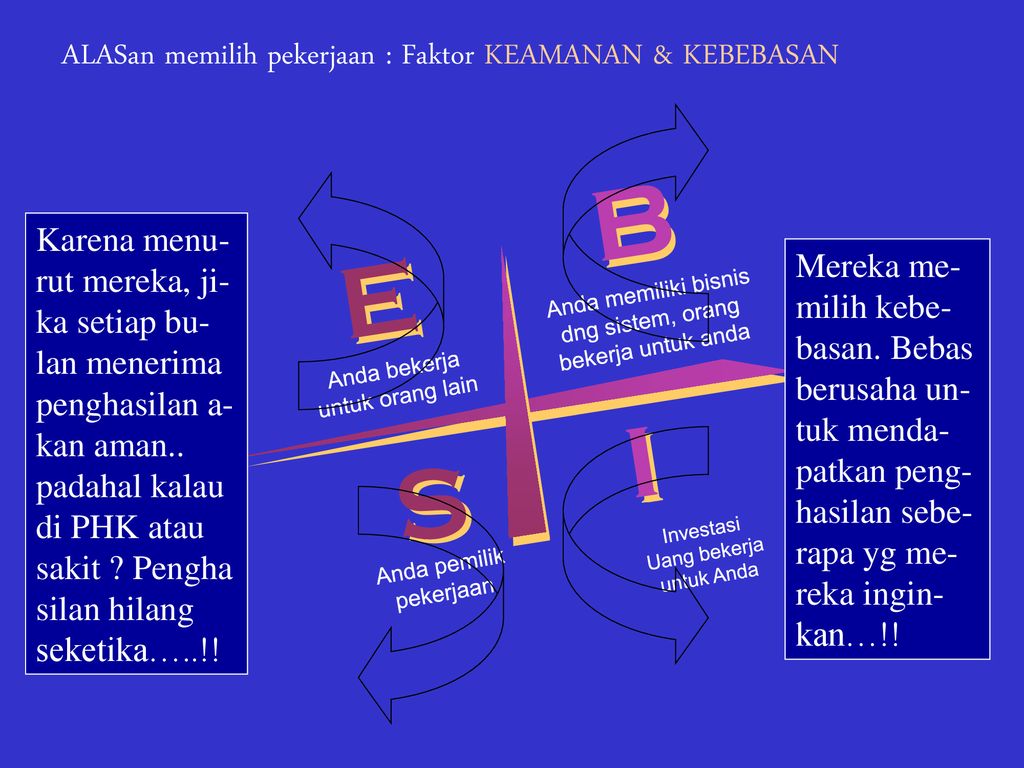

In order to understand the different reactions my rich and my poor dad had, you need to understand that there are two categories of people in the world, those who see the world through the left side of Rich Dad’s CASHFLOW Quadrant and those who see it through the right side. For years, I’ve taught on the CASHFLOW Quadrant.

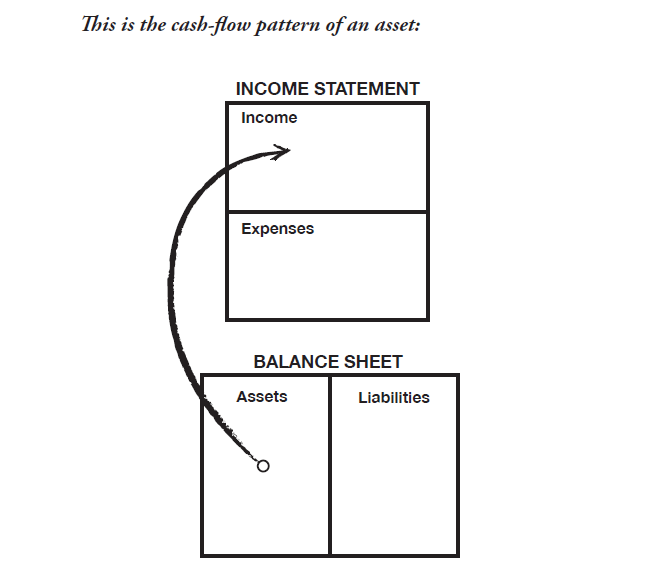

Rich people acquire income producing assets. The poor and the middle class acquire liabilities, but they think they are assets. This is the Cash Flow Pattern of an Asset. The top two boxes represent an Income Statement, identifying money coming in and going out. The bottom diagram is the Balance Sheet showing a person's assets and liabilities.

Jul 28, 2020 · This is obvious enough. But the most deceptive investments look like assets, but are actually liabilities. In Rich Dad, Poor Dad, assets and liabilities are explained, and you’ll learn which is which. Liability: Buying a House as a Primary Residence. In Rich Dad, Poor Dad assets and liabilities are one of the biggest factors in what makes someone rich. Rich Dad’s view is simple: buy assets, avoid liabilities.

Poor and middle class people acquire liabilities, but they think they are assets." Robert Kiyosaki, Rich Dad, Poor Dad This is such a basic and important rule that's missed by too many people, so let's start with the fundamentals.

"The rich don't work for money" is the title of the first chapter of Rich Dad Poor Dad. See, the rich don't work for money, instead they work to acquire assets. When I played Monopoly as a kid, my rich dad wasn't simply playing a board game with his son and me to pass the time. He was teaching us the cash flow formula, "4 green houses 1 red hotel."

Rich Dad Poor Dad an attempt to ppt the concept of Robert T Kiyosaki Slideshare uses cookies to improve functionality and performance, and to provide you with relevant advertising. If you continue browsing the site, you agree to the use of cookies on this website.

Rule #1: You must know the difference between an asset and a liability- and buy assets. "Rich people acquire assets. The poor and middle class acquire liabilities they think are assets," rich dad says. The biggest challenge poor people have is knowing the difference between an asset and a liability.

Rich Dad Poor Dad (Robert Kiyosaki) a year ago by . N N. 75% average accuracy. 219 plays. 10th - 12th grade . History, Life Skills. 3 Save Share Copy and Edit Edit. ... Assets, liabilities, and equity (capital) of a business. Business revenue (income) and expenses <p>Total income of employees in the business</p>

"Rich Dad Poor Dad" wasn't and isn't a get-rich-quick book. It was a fundamental shift in thinking about money and finances. It was a fundamental shift in thinking about money and finances. It was about building a portfolio of cash-flowing assets that would free you up financially and allow for a secure retirement.

The Rich Dad Scam that your home is an asset was prevalent when I first wrote “Rich Dad Poor Dad.”. That was in 1997, and everyone’s home values were climbing. It was easy to assume that your house was an asset because it was potentially making money for you in the long run through appreciation.

Lesson 2: Buy Assets, Not Liabilities. The key is to buy things that generate income (assets). You do NOT want to buy things that lose money over time or incur large expenses (liabilities). This is number two of the Rich Dad, Poor Dad lessons. This is obvious enough.

Kiyosaki passes on one rule from his rich dad: "You must know the difference between an asset and a liability, and buy assets." The definitions he uses are very simple: Assets are anything that puts money in your pocket. Liabilities are anything that takes money from your pocket.

According to Robert Kiyosaki author of Rich Dad, Poor Dad, A Liability is something that takes money out of your pocket. The poor will buy things. They lack a long term perspective so they buy consumables and enjoy using them up quickly. Typical "Assets" (Liabilities) of the Poor: A Car- It takes money out of your pocket in a variety of ways.

An animated lesson on assets and liabilities inspired by the book "Rich Dad, Poor Dad" by Robert T. Kiyosaki. One of the most valuable books I've ever read!...

Rich don't give a damn about Liabilities, they work on acquiring assets. They know that most of the world is in the trap of working hard, making money, paying bills, sleep and repeat.

Dec 25, 2020 · Assets Versus Liabilities: A Rich Dad Poor Dad Lesson! This article is a guest post from the blog Investors On The Rise. A very important lesson I have learned throughout my self-studies of personal finance is from the book Rich Dad Poor Dad by Robert Kiyosaki.

Sign In. Details ...

0 Response to "40 rich dad poor dad assets liabilities diagram"

Post a Comment