45 put option payoff diagram

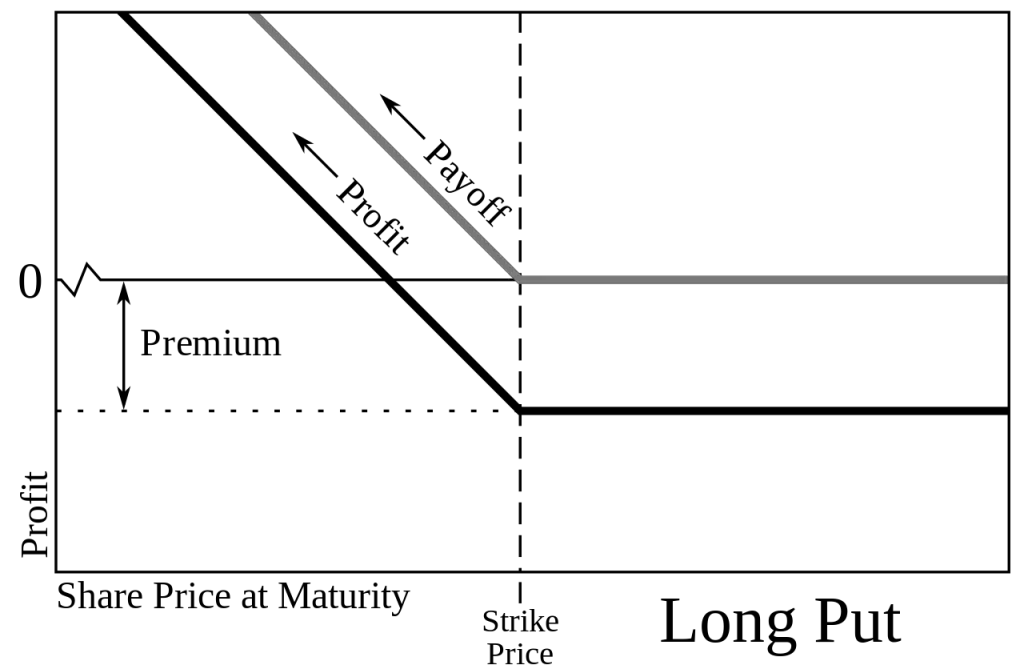

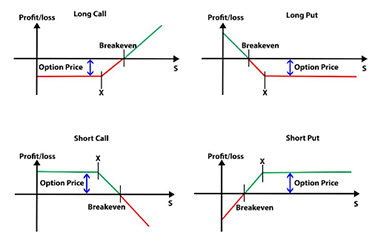

The strategy uses two put options to form a range consisting of a high strike price and a low strike price. Bear Put Spread Payoff Diagram. Understanding payoff graphs (or diagrams as they are sometimes referred) is absolutely essential for option traders. A payoff graph will show the option position’s total profit or loss (Y-axis) depending ... However, payoff charts become very useful when looking at combinations of options i.e. when more than one leg is in the strategy. Take an option straddle for example. A straddle is a combination of two options; a long call and long put option with the same expiration dates and strike prices. Below is a straddle graph.

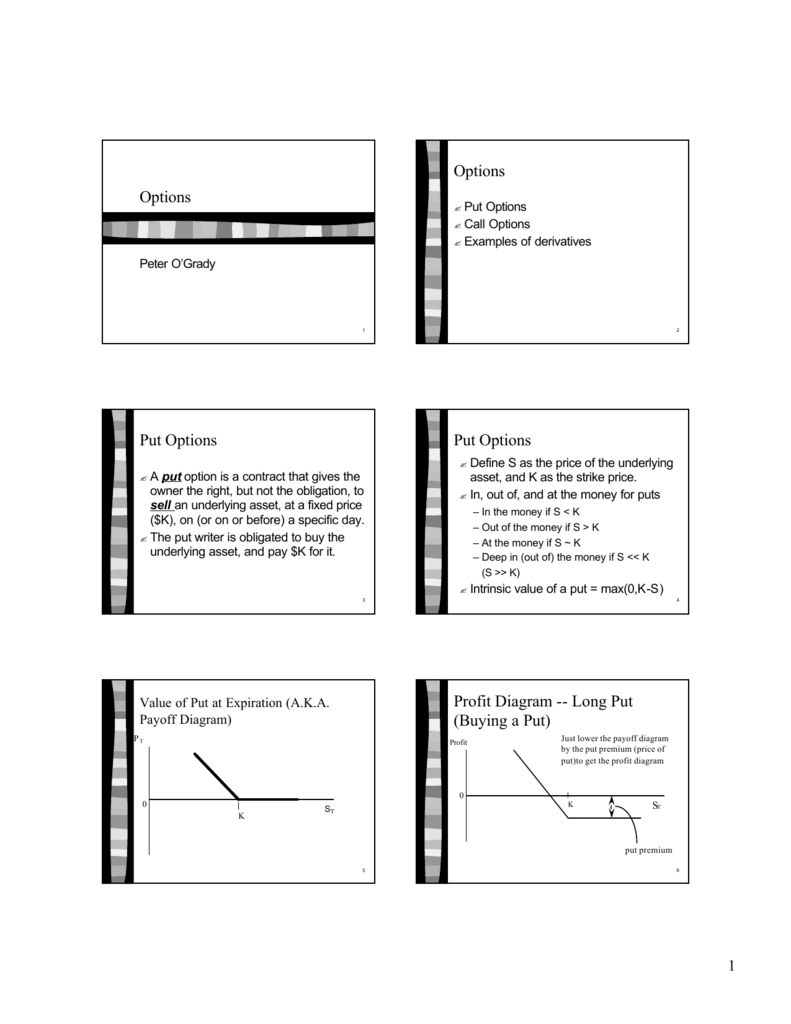

A Put option gives it owner the right to sell the underlying at a price and time agreed upon the date of purchase of the option contract. A Call option is a bullish instrument. You purchase it when you expect prices to rise and want to benefit from that rise. As you can see in the payoff diagram above the value of call option increases when ...

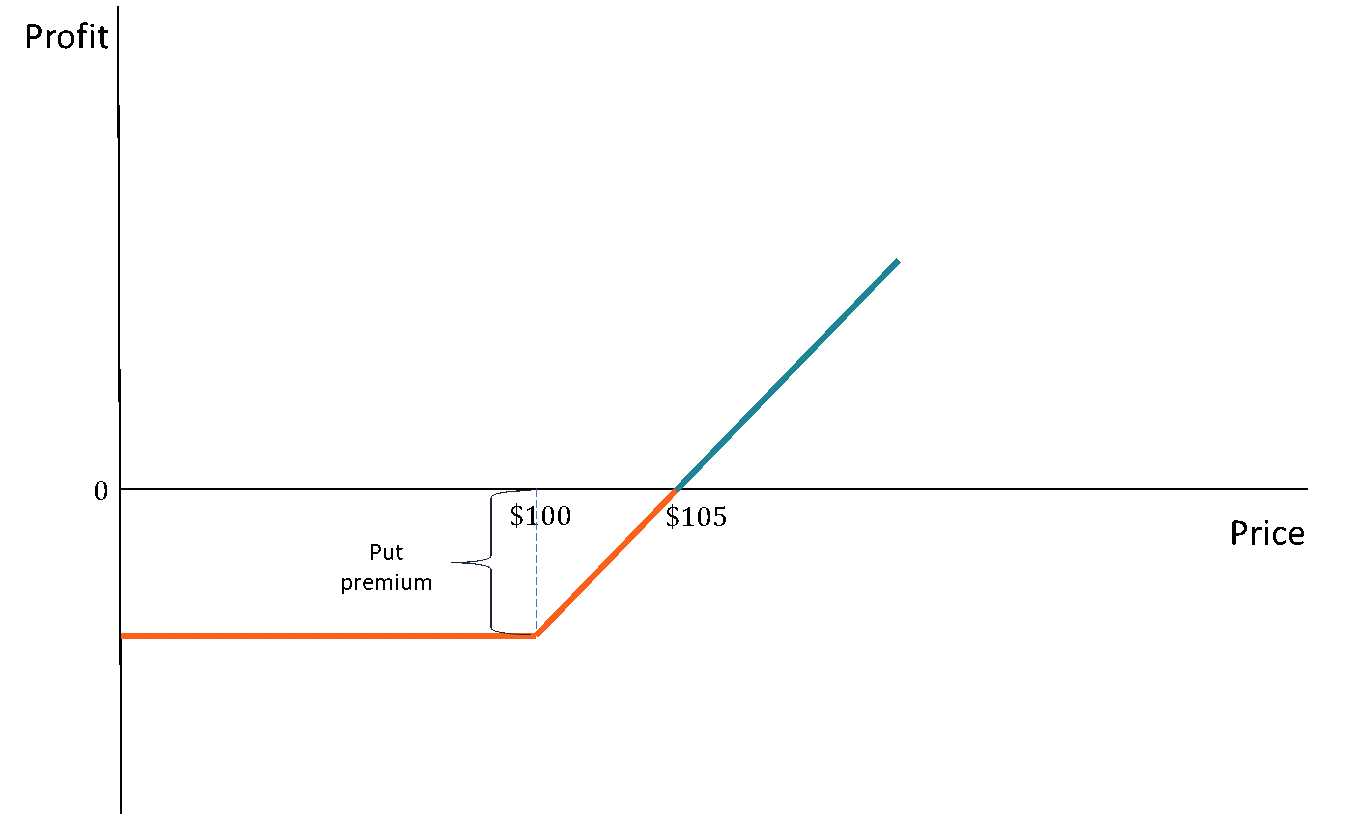

Put option payoff diagram

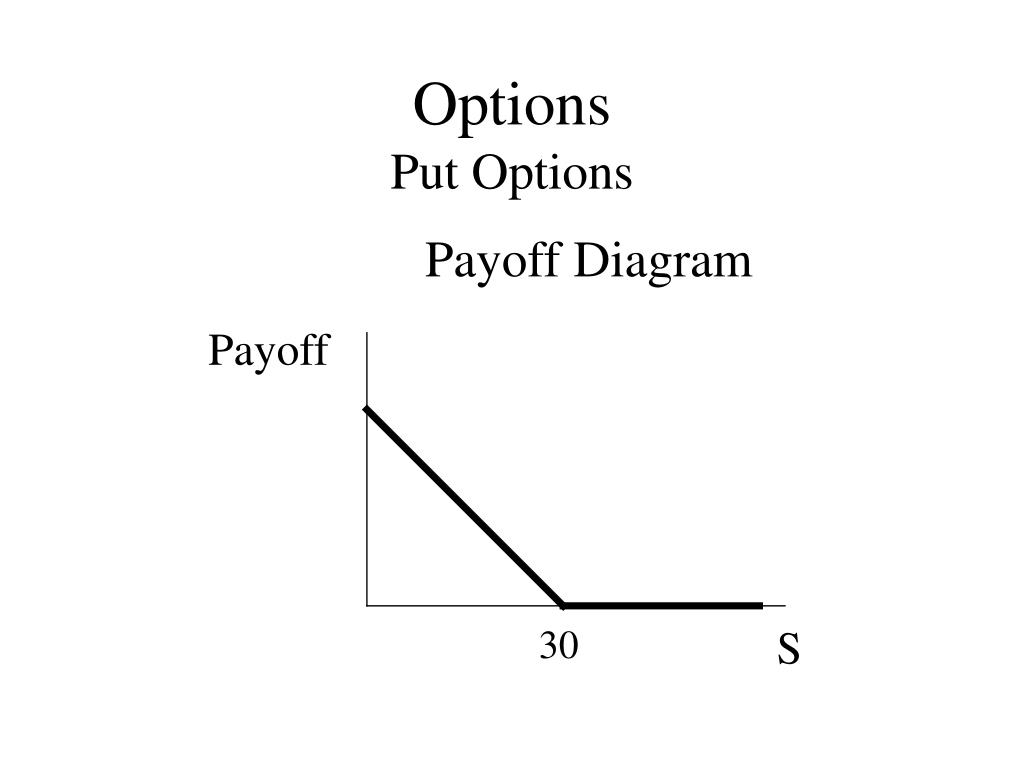

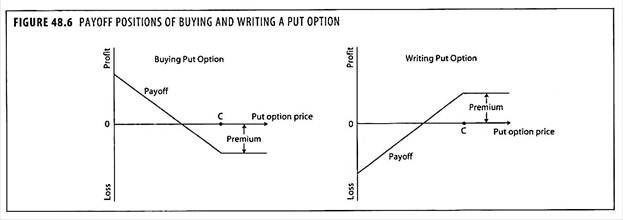

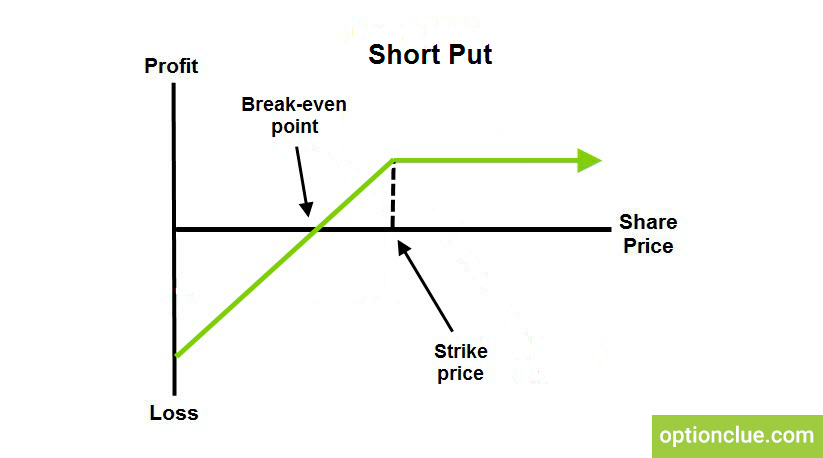

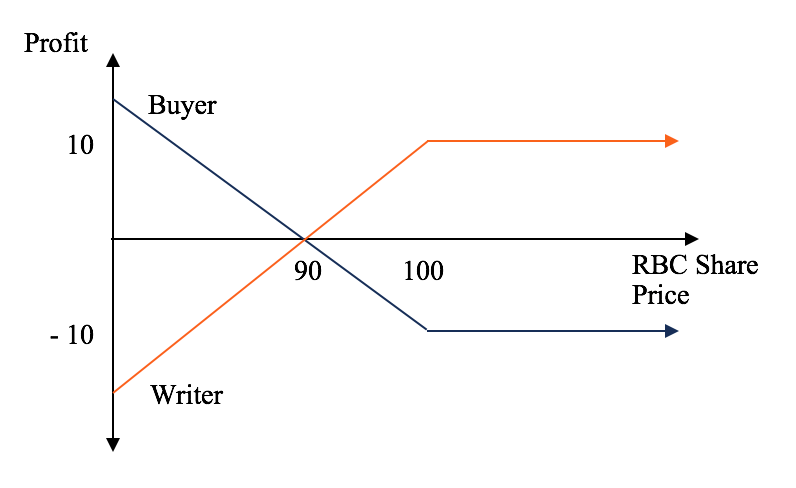

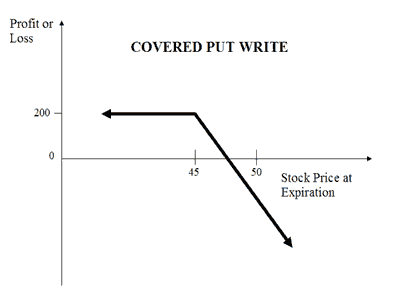

This diagram shows the option's payoff as the underlying price changes for the long put position. If the stock is above the strike at expiration, the put ... Transcript. A put payoff diagram is a way of visualizing the value of a put option at expiration based on the value of the underlying stock. Learn how to create and interpret put payoff diagrams in this video. Created by Sal Khan. This is the currently selected item. Call options tend to be purchased by investors who hold a bullish view on the underlying, while a bearish view would be expressed by buying a put option. As a result, the option seller will have the converse payoff profile to the option buyer, and the sum of the positions of buyer and seller is zero.

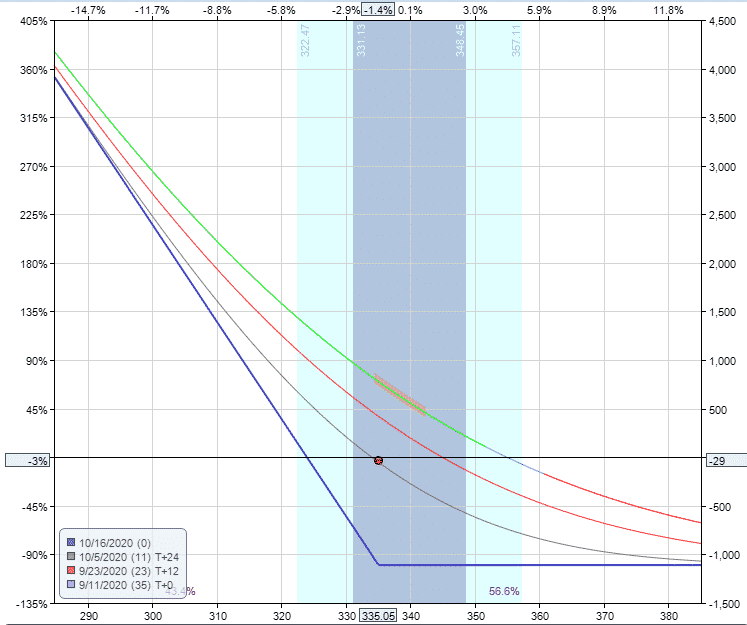

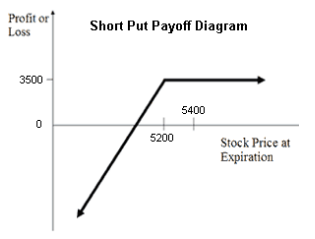

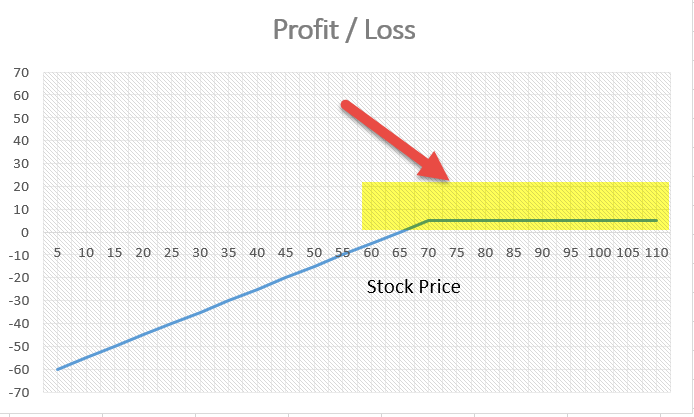

Put option payoff diagram. The put option was an SPY 335 strike put purchased for $11.10 per contract or $1,110 in total. The breakeven price at expiration is 323.90 (strike price minus the premium paid). The blue line shows the expiration payoff that you are now familiar with and the purple line shows what is known as a “T+0” line. Profit & loss diagrams are the diagrammatic representation of an options payoff, i.e., the profit gained or loss incurred on the investment made. The diagram below shows a profit and loss diagram for a “long call option.”. The vertical axis indicates the profit/loss earned or incurred. All amounts above zero level represent a profit earned ... Put Options. By now, if you have well understood the basic characteristics of call options, then the payoff and profit for put option buyers and sellers should be quite easy; simply replace \( “S_T-X” \text{ by } “X-S_T” \). Value at Expiration of a Put Option. The payoff and profit profiles of a put option are represented as follows ... Make Option Strategy Pay-off charts of Nifty, Bank Nifty and other indices, and stocks.

This page explains put option payoff. We will look at: A put option’s payoff diagram; All the things that can happen with a long put option position, and your profit or loss under each scenario; Exact formulas to calculate put option payoff; Calculation of put option payoff in Excel; Calculation of a put option position’s break-even point (the exact price where it starts to be profitable) 18 Oct 2021 — A put option gives the holder the right to sell a certain amount of an underlying at a set price before the contract expires, but does not ... A convenient way to envision what happens with option strategies as the value of the underlying asset changes is with the use of a profit and loss diagram, ... Call options tend to be purchased by investors who hold a bullish view on the underlying, while a bearish view would be expressed by buying a put option. As a result, the option seller will have the converse payoff profile to the option buyer, and the sum of the positions of buyer and seller is zero.

Transcript. A put payoff diagram is a way of visualizing the value of a put option at expiration based on the value of the underlying stock. Learn how to create and interpret put payoff diagrams in this video. Created by Sal Khan. This is the currently selected item. This diagram shows the option's payoff as the underlying price changes for the long put position. If the stock is above the strike at expiration, the put ...

Ppt Figure 17 1 Payoff Diagram For A Forward Contract A Plain Vanilla Call Option And A Cash Or Nothng Digital Option Powerpoint Presentation Id 663293

/call-and-put-options-definitions-and-examples-1031124-v5-8566395195f0403aaf5b4ad9e5cc9364.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Put_Option_Jun_2020-01-ed7e626ad06e42789151abc86206a1f3.jpg)

0 Response to "45 put option payoff diagram"

Post a Comment